Speed makes headlines. Substance shapes history.

In the high-stakes arena of global trade, timing is not everything. Clarity and depth often matter more.

Last week’s whirlwind announcements of trade deals between India and its Western partners underscored that truth.

On January 27, 2026, the European Union sealed a landmark free trade agreement (FTA) with India after nearly two decades of negotiations, hailed by European Commission President Ursula von der Leyen as the “mother of all deals.”

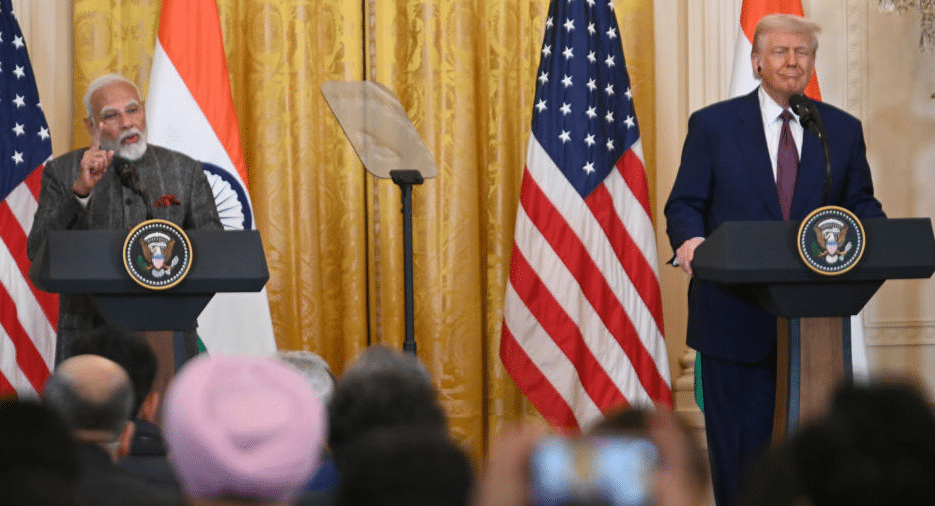

Just six days later, on February 2, U.S. President Donald Trump took to Truth Social to declare a “done” trade pact with Indian Prime Minister Narendra Modi, slashing U.S. tariffs on Indian goods from 50 percent to 18 percent in exchange for sweeping commitments from New Delhi.

Trump’s move grabbed headlines for its speed, sealed in a single phone call. But beneath the spectacle lies a haze of ambiguity that could ultimately tilt the balance in Europe’s favor, reshaping global economic dependencies away from U.S. dominance.

“This is not just about tariffs or trade volumes,” one analyst noted in the original Euractiv report. “It is about geopolitical maneuvering in an era of uncertainty.”

Unintentionally, the Trump administration may be accelerating a multipolar world less reliant on American leverage.

The Long Road to Agreement: Patience Meets Pressure

The story behind these parallel deals is one of endurance for Europe and opportunism for Washington, shaped by decades of economic friction and recent geopolitical shocks.

EU-India negotiations began in 2007 under a proposed Broad-based Trade and Investment Agreement. Talks stalled in 2013 amid disputes over tariffs, intellectual property rights, services access, and regulatory standards. These divisions reflected the EU’s emphasis on sustainability and labor protections versus India’s caution over agriculture and domestic industries.

Negotiations were revived in 2022 and gained urgency after Russia’s invasion of Ukraine, COVID-era supply chain disruptions, and Trump’s renewed trade wars following his return to office in 2025.

What sets the EU deal apart is its breadth.

The agreement spans 30 chapters covering tariffs, services, investments, digital trade, and climate commitments. It eliminates or reduces duties on 96.6 percent of EU exports to India by value, potentially doubling European goods exports by 2032 and saving €4 billion annually in tariffs.

For India, the pact opens access to a combined $24 trillion market while boosting labor-intensive sectors such as textiles, leather, and gems, industries employing millions.

Crucially, the agreement arrived as Washington imposed tariffs of up to 50 percent on Indian goods in April 2025 over New Delhi’s purchases of Russian oil, giving India a powerful incentive to hedge against U.S. volatility.

A Rapid Reset from Washington

By contrast, the U.S.-India pact appears more improvised.

Trade tensions escalated last year when Trump introduced a 25 percent “reciprocal” tariff, later doubled to 50 percent in August over India’s discounted Russian crude imports. Six months of strain followed, during which India expanded engagement with China and Europe.

Trump’s February announcement promised reduced tariffs, zero barriers on U.S. goods, and sweeping commitments from India, including halting Russian oil purchases and pledging $500 billion in American imports.

Indian officials offered little confirmation.

Trade Minister Piyush Goyal stressed continued protections for farmers, contradicting U.S. claims of wide agricultural access. The $500 billion figure also raised eyebrows. U.S. exports to India totaled just $83 billion in 2024.

“This looks more like a return to the pre-tariff status quo,” said economist Sony Kapoor, “triggered largely by the EU deal’s momentum.”

Even Trump’s celebratory tone may backfire. U.S. Ambassador Sergio Gor mocked Europe’s 19-year negotiation process, but European Parliament trade chair Bernd Lange warned that the U.S. pact’s vagueness, including unverified claims about Russian oil, risks future derailment.

Economic Stakes: Europe Advances, Washington Stabilizes

The economic consequences of both agreements are significant, though Europe’s appear more durable.

EU-India trade already stands at €180 billion annually and supports roughly 800,000 European jobs. Under the FTA, bilateral commerce could rise by 41 to 65 percent, adding 0.12 to 0.13 percent to both economies.

European automakers, spirits producers, and machinery exporters stand to benefit from tariff reductions. India gains expanded access for textiles, with 90.7 percent becoming duty-free immediately, alongside growth in services exports.

Agriculture remains sensitive. India’s “farmers-first” exclusions on dairy and key crops limit EU agrifood opportunities, preserving protections for smallholders.

The U.S. agreement stabilizes $129 billion in bilateral trade, easing pressure on Indian exporters who faced GDP losses of up to 0.5 percent under previous tariffs. Textile and gemstone producers now anticipate 20 to 25 percent annual export growth to the United States.

Still, the ambitious $500 billion target under Washington’s “Mission 500” framework appears distant without structural changes.

Both deals are expected to divert trade away from China by an estimated 5 to 9 percent, aiding Europe’s de-risking strategy and India’s supply chain diversification. Indian small and medium enterprises gain structured access to Western markets, boosting employment across labor-intensive sectors.

Redrawing the Global Trade Map

Geographically, the agreements are reshaping supply chains across Asia, Europe, and North America.

India’s central role in the Indo-Pacific enhances its leverage while reducing reliance on any single partner. The EU deal establishes a vast free-trade zone for nearly two billion people, stretching from Lisbon to Lakshadweep and enabling east-west trade corridors less dependent on U.S.-centric routes.

European companies are likely to source more from India as part of “China-plus-one” strategies, accelerating shifts in manufacturing hubs.

Geopolitically, Trump’s tactic of using trade pressure over Russian oil has nudged India closer to Europe, weakening U.S. influence in the process.

As Kapoor observed, Washington is “rebalancing the world away from unhealthy dependence on the US.”

India continues calibrated energy purchases from Russia while maintaining ties with Beijing, Brussels, and Washington, reinforcing its multipolar posture. For Europe, the FTA strengthens strategic autonomy amid U.S. unpredictability and Chinese competition.

A Pyrrhic Victory for Washington

Risks remain. The EU agreement still requires ratification by the European Parliament, and Trump’s transactional approach leaves open the possibility of sudden reversals.

Yet the contrast is striking.

Europe arrives with a comprehensive, rules-based framework. Washington offers speed, but few details.

In the end, Trump’s fast but opaque pact may prove a pyrrhic victory. Its lack of structure stands in sharp contrast to Europe’s methodical approach, positioning the EU as India’s more reliable long-term partner.

As global trade fragments, the lesson is clear:

In diplomacy, haste rarely outperforms substance.

For businesses and policymakers alike, the message is unmistakable. Diversify or risk isolation in an emerging multipolar world.